Mugabe has gone, but Zimbabwe’s economy is still struggling [Note #38]

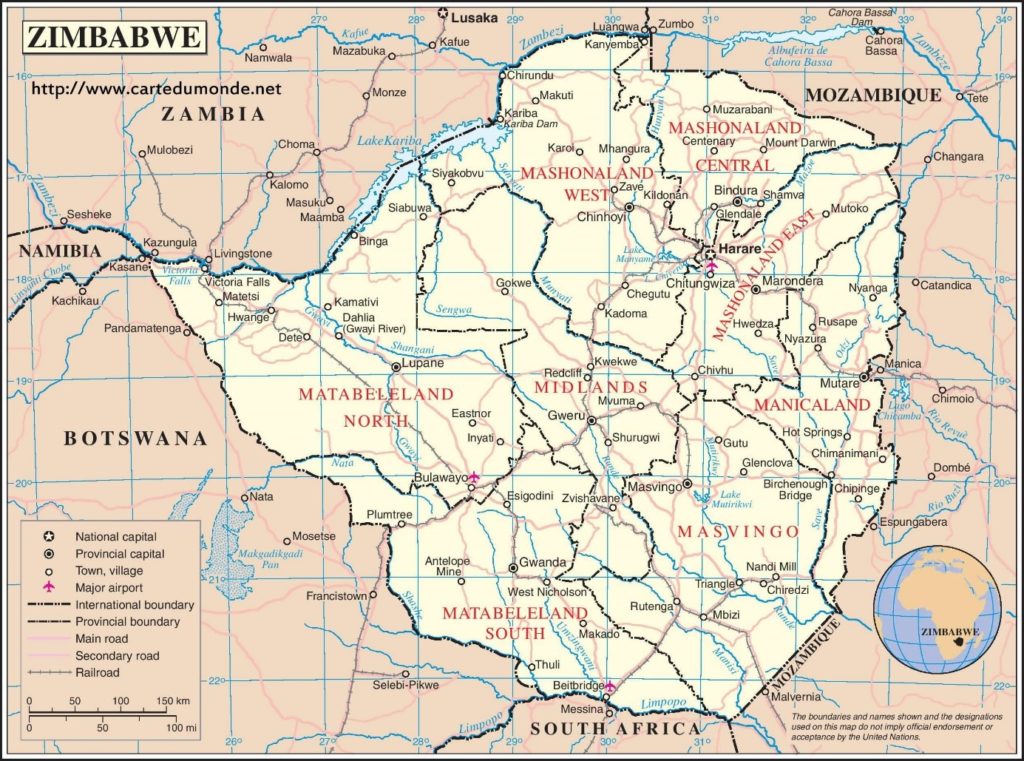

Zimbabwe is a Sub-Saharan nation which embodies great economic potential. The country has a large educated and young population, an established industrial infrastructure inherited from the colonial period and approximately 20 million hectares of arable land[1]. It has great tourists attraction centers such as the Victoria falls, Great Zimbabwe Ruins, Nyanga mountains and a huge potential market in Sub-Saharan Africa. There is diversity in underground wealth, such as, tantalum, chrome, nickel, granite, nickel, lithium, gold and diamonds amongst others [1]William Minter, Elizabeth Schmidt, “When Sanctions Worked: The Case Of Rhodesia Reexamined”, African Affairs, Vol. 87, No. 347 (Apr., 1988), p. 207-237. . It has the capacity to achieve self-sufficiency and was once the breadbasket and one of the high performing economies in Africa[1]. Aside these positive economic indicators, the country has been experiencing an on-going economic meltdown since the early 1990s due to a number of factors all pointing towards economic mis-managements and droughts. The aim of this article is to map out how and why this has persisted despite a solid economic foundation and to suggest some potential solutions.

Historical Economic Background

Zimbabwe was a British settler colony, between 1890-1965, called Southern Rhodesia. As a settler colony it economically meant it was to serve as a permanent second home for Britain. Much effort was put into developing the country’s infrastructure and set up a functional economic base unlike what was done in other non-settler colonies.

In 1965, the white settler government declared independence from the British imperial power and changed the country’s name to Rhodesia, under president Ian Smith[2]Patrick Bond, “Zimbabwe’s Economic Crisis: Outwards Vs. Inwards Development Strategy For Post-Nationalist Zimbabwe”, Labour, Capital And Society / Travail, Capital Et Société, Vol. 33, … Continue reading. This constituted the white settlers’ reaction against the rising de-colonization politics of the day. In this phase, Rhodesia was put under sanctions, but it experienced the highest economic growth the country had ever experienced in the same phase. The sanctions forced the Rhodesian government to adopt import substitution policies, which really helped the economy. In particular, the manufacturing industry experienced a booming growth during this

period[3]Patrick Bond, “Zimbabwe’s Economic Crisis: Outwards Vs. Inwards Development Strategy For Post-Nationalist Zimbabwe”, Labour, Capital And Society / Travail, Capital Et Société, Vol. 33, … Continue reading. The economy became more diversified and stopped focusing solely on agriculture.

In 1980, Rhodesia became Zimbabwe with the attainment of political independence after a decade of war. The first president was Robert Mugabe. The first African government operated somewhere in between socialist and capitalist paradigms. Its first decade was largely filled with social expenditure and policies meant to cushion the long deprived African majority[4] Ibid.. The government’s policy was growth with equity. Important developments took place in the health and education sectors, where several schools and hospitals were established nationwide and offered free services to the public.

In the decade 1990-2000 however, the economy began to collapse, signs of economic problems started to show. This was largely a result of the government’s huge expenditure in social welfare and failure to manage the budget, its reserves had been depleted[5] Ibid.. The government adopted economic structural adjustment program (ESAP) in 1993 as an attempt to get access to loans as well as to revamp the economy and reduce government expenditure, but by 1997 they were abandoned because they were failing to resuscitate the economy[6]Alois S. Mlambo, “Becoming Zimbabwe Or Becoming Zimbabwean: Identity, Nationalism And State-Building” , Africa Spectrum, Vol. 48, No. 1 (2013), p. 49-70. ESAP resulted in public service retrenchments as it was cutting down the wages expenses, price hikes as government cut down on subsidies, introduction of tuition fees in schools and medical fees in public hospitals. As a result of these cut downs and increasing economic challenges, the African population started to demand access to more resources, such as land and businesses. The government faced a huge task to impress the population because widespread strikes were occurring, and an opposition party called the Movement for Democratic Change (MDC) was now present. This was the genesis of the rapid economic meltdown in Zimbabwe.

The defining economic change

In 1999, a referendum election was held, and MDC won. The Zimbabwe African National Unity-Patriotic Front (ZANU-PF) government needed to gunner support by responding quickly to indigenous Zimbabweans’ hunger for resources and punish white settlers who had chosen to support the MDC in the referendum petition[7] Ibid.. The result was the famous Fast-Track Land Reform Program (FTLRP), which occurred between 2000 and 2003[8]Lloyd M. Sachikonye, “From ‘Growth With Equity’ To ‘Fast-Track’ Reform: Zimbabwe’s Land Question” , Review Of African Political Economy, Vol. 30, No. 96, War & … Continue reading.

The process was spontaneous, unplanned and brutal for the white farmers and foreign farm laborers, but beneficial to the indigenous Zimbabweans. Agriculture was and still is Zimbabwe’s economic back-bone. This achieved political and ideological success for the ruling party’s government, but it ruined the economy and the country’s international image. The land disparity needed to be addressed but the process in which it was caused arm to the economy.

Immediately, the international markets were lost, agricultural production trumpeted down, and economic sanctions were placed on Zimbabwe by the United Nations in 2002[9]John Prendergast, Jamal Jafari, “Zimbabwe On The Brink” , Georgetown Journal Of International Affairs, Vol. 5, No. 1 (Winter/Spring 2004), p. 105-112.. The new African farmers were given smaller pieces of land, but they were incapacitated in many ways; they neither had the capital and machinery, nor the expertise to run the farms and continue to sustain the country’s agricultural needs. This was followed by a huge capital flight; industries and mines were closing or downsizing. Important industries such as ZISCO steel and David Whitehead textiles completely shut down[10] Ibid.. This is one move the country is still trying to recover from and progress is very slow.

Contemporary problems and possible solutions

Zimbabwe’s current economic problems are a result of colonial and post-colonial African government’s policies as well as international influences. Some scholars argue it is the colonial system that entrenched Zimbabwe into these problems by creating anarchy and centralizing power that the post-colonial African government adopted[11]John Makumbe, Dennis Masaka.. Some others argue these problems are a result of African political governments’ ignorance to economic issues that are particularly central to development[12] Patric Pond, L. Sachikonye.. The government puts more emphasis on social and historical matters in their agendas than on economic and scientific development. Other scholars put the blame entirely on the negative effect of frameworks such as globalization and the imposing role of international institutions such as the World Bank and International Monetary Fund (IMF) on periphery economies such as Zimbabwe[13] Michel Chossudovsky, Kwame Akonor..

Current economic challenges Zimbabwe is facing include liquidity crisis that largely affect trade, unemployment, indebtedness, poor infrastructure, under-preforming agricultural sector, poor policy implementation, corruption, brain drain and disease burdens. Aside these problems, the government and different organizations attempt, in several ways, to salvage the country or provinces from these inherent problems. The huge impeding factor however is greedy politics fashioned in democracy rhetoric and democracy politics. It is a sad reality that African governments continue to choose politics and power over economic progress.

Liquidity crunch is one of the problems inhibiting economic progress in the country. Currently it is operating under a multi-currency system after the demise of the Zimbabwean dollar in 2008-2009 but the main currency used is the US dollar. However, the beginning of 2016 saw this form of money becoming increasingly unavailable in the country. To counter the shortage, in November 2016, the Reserve Bank introduced a pseudo currency called bond-notes which is based on the US dollar, hence has the same value with the $US[14]Press Statement On The Introduction Of Bond Notes.. This bond currency is legal tender in Zimbabwe however it is still difficult to access in the country, and it had a negative impact of driving the actual $US out of circulation. Ordinary Zimbabweans spend hours and even nights in bank queues to access just $50 bond notes[15] The Standard, “Zimbabweans Sleep In Bank Queues As Bond Notes Beckon”, Nov 6, 2017.. Electronic transaction is the most widely adopted mean of transaction, even though mandatory fees are inconvenient. Electronic transactions are also not very flexible for the large informal sector and small-scale import-export trade.

Another effect of the bond note was the development of a currency black market which undercharged the bond notes in exchange for foreign currency. An uneven currency situation has been created, such that if you have 500 US$ in your bank account, you might actually have less than that, the value depending on the black market value of the day which is fluctuating depending on scarcity and demand of the actual US$.

Another big economic challenge is unemployment. The current unemployment rates are estimated somewhere between 60% and 85%[16] News Day, “US$ Black Market Rates Spirals”, September 18, 2018.. This is a clear indicator that the industries and other economic sectors are shrinking instead of expanding. The young professional students must buy their way into getting a job or an attachment. As a result, an exodus of youth is happening as they seek greener pastures in the diaspora.Young Zimbabweans are scattered all over the world, the major destinations beeing South Africa, Britain, Dubai and China. There is also a booming informal market because of the natural death of the formal sector.

Zimbabwe’s agriculture sector has been underperforming since the FTLRP land reform. The resettlement resulted in the further breaking up of one farm into several farming and residential areas. Nowadays it is very common to find that redistributed land still lays idle without any actual farming taking place. Also, because the new farmers lacked expertise, the quality and quantity achieved per hectare decreased drastically. In 2000, the tobacco output was 228 million kgs. By 2004, output decreased to 69 million kgs and wheat output which peaked at 325 000 tons in 1999 averaged 20 000 tons in 2017[17]Lloyd M. Sachikonye, “From ‘Growth With Equity’ To ‘Fast-Track’ Reform: Zimbabwe’s Land Question” . In addition, the farmers have become more seasonal, restricted by the rainy season patterns.

In this regard, the government made many attempts to provide farmers with inputs such as fertilizers and tractors and to set up irrigation projects or co-operatives. However, the major drawback problem seems to be that these projects are mainly planned to harness political agenda rather than the actual pressing need. Information and empowerment of the farmers is as crucial as financial aid. The farmers need to understand the international market trends, to understand farming as a business and to take charge and develop themselves rather than to have to wait for the government initiative.

Poor infrastructure is affecting economic progress in Zimbabwe. Most of the current building in towns and cities of Zimbabwe are dated from the colonial period, with little or no upgrading since then. Cities such as Harare are now considered overpopulated because the city planning is failing to keep up with the urbanization process and population needs. Road linkages are still poor. The government introduced a tollgate system as a taxation to fund construction and renovation of current road system[18] The Sunday Mail, New Toll Gates For Major Highways, 23 August 2015.. However, the process is quite slow in actually improving the road infrastructure and is flawed with inconsistences. Communication infrastructure such as the Internet is expensive for an ordinary Zimbabwean and is still considered a luxury. It is these trends that limit ordinary people from accessing opportunities that would better business and information.

Zimbabwe has a huge disease burden. This is as much an economic problem as it is a social one. Zimbabwe is one of the sub-Saharan countries most affected by the the HIV and AIDS endemic in the 2000s.[19] Lori Bollinger Et Al, The Economic Impact Of AIDS In Zimbabwe, The Futures Group International In Collaboration With: Research Triangle Institute (RTI) The Centre For Development And Population … Continue reading To date, ARVs’ import to Zimbabwe incurs huge costs and the country spends many times more to raise awareness and sustain disease-monitoring programs. In addition, diseases such as malaria, cholera and typhoid are always lurking around. There is need, every now and then, to fight these epidemics. While the last two are sanitation diseases caused by overpopulation and poor service delivery services for water in cities such as Harare, malaria mostly affect the dryer belt of Zimbabwe. It is because the country mostly depends on imports and its weak developed bio-medical health system that these are big economic issues for the nation.

Poor economic policies, which are continually mixed with the ruling party’s political interests, are a major economic progress impediment. One of these is the 51% indigenization policy which is a huge scholarly debate in Zimbabwe. While there is need for foreign direct investment, such a policy is not really inviting and accommodating to investors.

Also, the country has a booming informal sector. Instead of trying to fight this sector, it is the duty of the government to incorporate and device ways of protecting, promoting and cushioning such business. The government, instead, views them as a disturbance and chooses to chase them out of the city or to conscript their products[20] News Day, Government, Vendors To Square Up In Court, 24 January 2018..

In addition, Zimbabwe’s economy has turned into an import hub, importing supplementary food, clothing and almost everything else yet. There are struggling informal traders who are into carpentry and clothing producing some of the imported goods.

Corruption continues to entrench poor economic development in the country. It discourages hard work because what rewards are patronage and other factors despite one’s productivity. It is corruption that facilitates the government officials to steal for the millions who would be living in poverty and struggle and still get away with it. There is an episode that most Zimbabweans always repeat in conversation about $15 Billion diamond revenue that went unaccounted for.No one in the government is accountable yet the county’s annual budget is just around 4 Billion dollars[21] The Standard, Mugabe And The $15 Billion Question, March 14, 2016.. It is staggering when elites can steal more than what the entire nation is surviving on.

Corruption is a disease that affects the very impetus for development and everything else just go haywire. This is coupled by heavy foreign debt the country caries. The country owes 10.97 Billon to different funders such as IMF and China, according to 2017 statistics[22]The Financial Gazett, Zimbabwe’s External Debt Soars -. It had a GDP of just $14.6 Billion in 2017 and a $4 billion national budget that cannot sustain the country for a year, thus the need to borrow. In this case, the future generations will have to pay for debts they did not get to enjoy.

These economic woes have caused Zimbabwe to be ranked one of the most impoverished countries in Africa despite its potential. The disturbance of the agriculture sector resulted in the failing of other important pieces that made up the economy. Some analysts feel Zimbabwe is on its way to developing an African oriented economy, however, it is the strong presence of the Chinese companies that is also alarming to them. Most people feel these are also entrenching a form of economic colonization and it is shady because the elites are benefiting from it. One thing certain is that Zimbabwe and the rest of Africa do need to associate with China just as with other high performing world economies. It is the manner of association that is not comfortable. For the case of Zimbabwe, the relationship is rather unfair as the Chinese capitalize in the weakness and the desperation of African politicians to withhold power and skew it to their economic benefit[23]CNN, The Chinese Connection To The Zimbabwe ‘Coup’, Nov 17, 2017.

The biggest task of the new government led by Emmanuel Mnangagwa is to restore and improve the country’s economic performance. The new government has been running under the mantra “Zimbabwe is Open for business”. This is an attempt to lure investors into the country. However, for the country’s economy to begin moving forward, there is need for restoration of fiscal order and business as well as consumer confidence. There is need for a stable dependable currency as well. The current government seems to be so far in achieving these fundamental economic needs. The expenditure of this government has so far run into deficits and it is far from implementing any meaningful currency reform[24] Zimbabwe Independent Business Weekly, “Mnangagwa Government Fails First Fiscal Test”, June 29, 2018.. Given these realities, there is still a long way of suffering to go for ordinary Zimbabweans.

Notes

| ↑1 | William Minter, Elizabeth Schmidt, “When Sanctions Worked: The Case Of Rhodesia Reexamined”, African Affairs, Vol. 87, No. 347 (Apr., 1988), p. 207-237. |

| ↑2, ↑3 | Patrick Bond, “Zimbabwe’s Economic Crisis: Outwards Vs. Inwards Development Strategy For Post-Nationalist Zimbabwe”, Labour, Capital And Society / Travail, Capital Et Société, Vol. 33, No. 2, (November2000), p. 162-191. |

| ↑4, ↑10 | Ibid. |

| ↑5 | Ibid. |

| ↑6 | Alois S. Mlambo, “Becoming Zimbabwe Or Becoming Zimbabwean: Identity, Nationalism And State-Building” , Africa Spectrum, Vol. 48, No. 1 (2013), p. 49-70 |

| ↑7 | Ibid. |

| ↑8 | Lloyd M. Sachikonye, “From ‘Growth With Equity’ To ‘Fast-Track’ Reform: Zimbabwe’s Land Question” , Review Of African Political Economy, Vol. 30, No. 96, War & The Forgotten Continent (Jun., 2003), p. 227-240. |

| ↑9 | John Prendergast, Jamal Jafari, “Zimbabwe On The Brink” , Georgetown Journal Of International Affairs, Vol. 5, No. 1 (Winter/Spring 2004), p. 105-112. |

| ↑11 | John Makumbe, Dennis Masaka. |

| ↑12 | Patric Pond, L. Sachikonye. |

| ↑13 | Michel Chossudovsky, Kwame Akonor. |

| ↑14 | Press Statement On The Introduction Of Bond Notes. |

| ↑15 | The Standard, “Zimbabweans Sleep In Bank Queues As Bond Notes Beckon”, Nov 6, 2017. |

| ↑16 | News Day, “US$ Black Market Rates Spirals”, September 18, 2018. |

| ↑17 | Lloyd M. Sachikonye, “From ‘Growth With Equity’ To ‘Fast-Track’ Reform: Zimbabwe’s Land Question” |

| ↑18 | The Sunday Mail, New Toll Gates For Major Highways, 23 August 2015. |

| ↑19 | Lori Bollinger Et Al, The Economic Impact Of AIDS In Zimbabwe, The Futures Group International In Collaboration With: Research Triangle Institute (RTI) The Centre For Development And Population Activities (CEDPA), September 1999. |

| ↑20 | News Day, Government, Vendors To Square Up In Court, 24 January 2018. |

| ↑21 | The Standard, Mugabe And The $15 Billion Question, March 14, 2016. |

| ↑22 | The Financial Gazett, Zimbabwe’s External Debt Soars - |

| ↑23 | CNN, The Chinese Connection To The Zimbabwe ‘Coup’, Nov 17, 2017. |

| ↑24 | Zimbabwe Independent Business Weekly, “Mnangagwa Government Fails First Fiscal Test”, June 29, 2018. |